Marsons Ltd Share Price Target: 2025 to 2030 Forecast & Stock Analysis

Marsons Ltd, a small-cap player or can say multibagger stocks in the power equipment sector, has recently caught the eye of investors due to sudden spikes in trading activity. While the company isn’t a major name, it operates in a sector with long-term growth potential.

Company Overview

Marsons Ltd is a leading player in the Indian manufacturing and industrial sector, specializing in electrical products, including transformers, switchgear, and other high-end electrical components. In this article, we will explore the Marsons Ltd share price target, financial analysis, growth potential, and provide a price forecast for the coming decades. If you’re considering investing in the industrial sector, Marsons Ltd could be a promising candidate.

- Established: 1976

- Director: Mr.Subhash Kumar Agarwala

- Stock Symbol: 517467 (BSE)

- Sector: Capital Goods – Electrical Equipment

- Website: marsonsonline.com

Fundamental Metrics

Key metrics as of March 2025:

| Market Cap | ₹3,335 Cr. | ROE | 12.42 % |

| P/E Ratio | 171.50 | EPS(TTM) | 1.13 |

| P/B Ratio | 31.12 | Dividend Yield | 0.00 % |

| Industry P/E | 96.80 | Book Value | -4.00 |

| Debt to Equity | 0.00 | Face Value | 1 |

| 52-Week High | ₹356 | 52-Week Low | ₹37.5 |

Read Also: Tilak Ventures Share Price Target

Cons

- Promoter holding has decreased over last 3 years: -42.7%

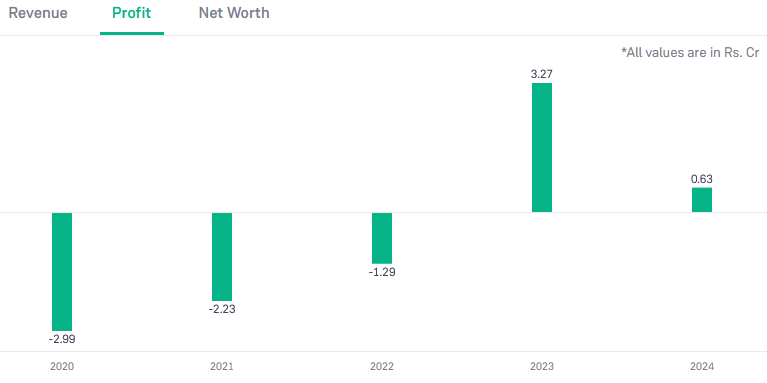

Marsons Ltd Financial Overview 2025

Current Share Price

As of the latest data, Marsons Ltd stocks round ₹194

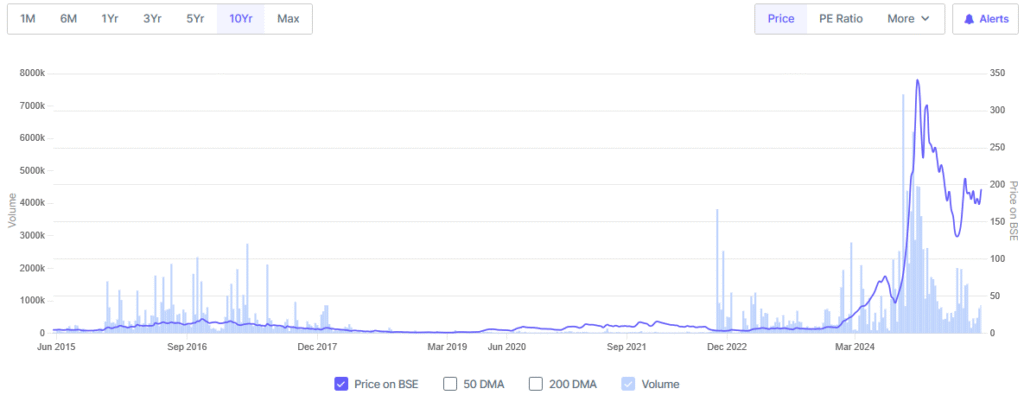

Marsons ltd Share Price History last 10 Years

Read Also: Best FMCG Stocks Under 100 in 2025

Marsons Ltd Shareholding Pattern

As of Mar 2025 the shareholding data are as following:

| Month | Promoters | DIIs | Public |

|---|---|---|---|

| Mar 2025 | 53.65% | 0.00% | 46.34% |

| Dec 2024 | 53.65% | 0.00% | 46.35% |

| Sep 2024 | 53.65% | 0.01% | 46.34% |

| Jun 2024 | 53.65% | 0.00% | 46.34% |

| Mar 2024 | 66.24% | 0.00% | 33.76% |

Marsons Ltd Stock Forecast 2025 to 2030

| Year | Target Price |

|---|---|

| Marsons Ltd Share Price Target 2025 | ₹215 |

| Marsons Ltd Share Price Target 2026 | ₹190 |

| Marsons Ltd Share Price Target2027 | ₹240 |

| Marsons Ltd Share Price Target 2028 | ₹320 |

| Marsons Ltd Share Price Target 2029 | ₹250 |

| Marsons Ltd Share Price Target 2030 | ₹350 |

Marsons Ltd Share Price Target 2025

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹215 | ₹140 | 2025 |

Marsons Ltd Share Price Target 2026

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹190 | ₹135 | 2026 |

Marsons Ltd Share Price Target 2027

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹240 | ₹155 | 2027 |

Marsons Ltd Stock Price Target 2028

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹320 | ₹185 | 2028 |

Marsons Ltd Stock Price Target 2029

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹250 | ₹145 | 2029 |

Marsons Ltd Share Price Target 2030

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹350 | ₹190 | 2030 |

Peer Company

- ABB India

- Siemens India

- CG Power & Ind

- BHEL

- Suzlon Energy

- Waaree Energies

- Hitachi Energy

Conclusion:

Marsons Ltd is a penny stocks poised for significant growth in India’s infrastructure sector. Marsons Ltd offers significant growth potential in the electrical manufacturing and industrial sector. With its strong product portfolio, the Marsons Ltd share price target suggests robust long-term growth. From 2025 to 2030, investors can expect solid returns if the company continues to execute its strategies effectively.

Read Also: IRB Infra Share Price Target

Disclaimer: The stocks mentioned above are shared purely for informational and research purposes. We are not authorized by SEBI (Securities and Exchange Board of India).These are not investment recommendations. Please make sure to do your own research or consult a financial advisor before making any investment decisions.