LT Foods Share Price Target 2025 to 2040: Is It Still a Good Long-Term Investment?

LT Foods, the company behind the popular Daawat rice brand, has shown steady growth over the years. Let’s explore its share price targets from 2025 to 2040 and see if it’s a smart pick for long-term investors.

Company Overview

LT Foods Limited is a leading Indian FMCG company best known for its popular basmati rice brand Daawat. With operations in over 65 countries, the company is involved in milling, processing, and marketing of rice and rice-based foods. LT Foods also focuses on organic and ready-to-eat products, helping it grow beyond just a rice business into a broader food solutions provider.

- Established: 1990

- MD and CEO: Mr. Ashwani Kumar Arora

- Stock Symbol: LTFOODS (NSE)

- Sector: FMCG

- Website: ltgroup.com

Fundamental Metrics

Key metrics as of March 2025:

| Market Cap | ₹12,611 Cr | ROE | 16.8% |

| P/E Ratio | 20.8 | EPS (TTM) | 17.19 |

| P/B Ratio | 3.51 | Dividend Yield | 0.55% |

| Industry P/E | 52.56 | Book Value | 111 |

| Debt to Equity | 0.03 | Face Value | 1 |

| 52-Week High | ₹452 | 52-Week Low | ₹186 |

The company has consistently delivered profit and revenue growth with stable margins, making it an attractive pick for long-term investors.

Read Also: Tilak Ventures Share Price Target

Pros

- Company has delivered good profit growth of 26.4% CAGR over last 5 years

Cons

- Promoter holding has decreased over last 3 years: -5.81%

LT Foods Financial Overview 2025

Current Share Price

As of the latest data, lt foods stocks price around ₹363

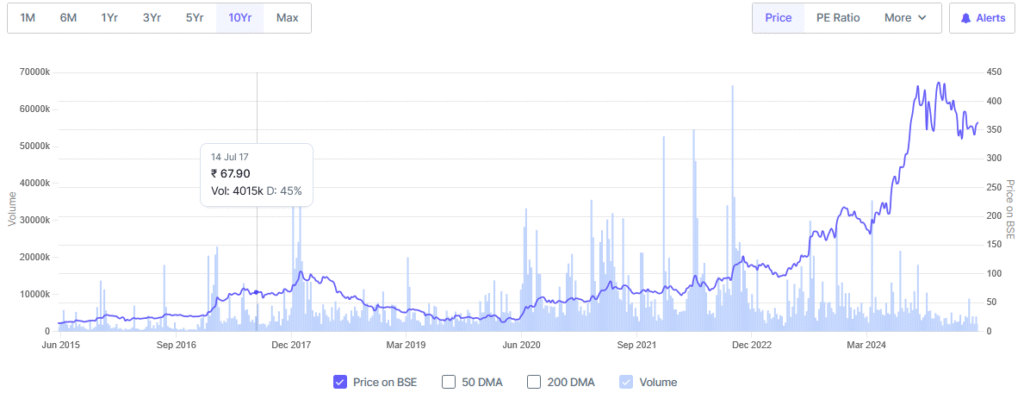

LT Foods Ltd Share Price History of last 10 Years

Read Also: Infibeam Share Price Target

Shareholding Pattern

As of Mar 2025 the shareholding data are as following:

| Month | Promoters | FIIs | DIIs | Public |

|---|---|---|---|---|

| Mar 2025 | 51.00% | 9.79% | 6.16% | 33.04% |

| Dec 2024 | 51.00% | 9.33% | 5.86% | 33.80% |

| Sep 2024 | 51.00% | 8.03% | 5.76% | 35.19% |

| Jun 2024 | 51.00% | 5.89% | 4.08% | 37.44% |

| Mar 2024 | 51.00% | 5.14% | 4.08% | 39.76% |

LT Foods Share Price Forecast 2025 to 2040

| Year | Target Price |

|---|---|

| LT Foods Share Price Target 2025 | ₹425 |

| LT Foods Share Price Target 2026 | ₹375 |

| LT Foods Share Price Target 2027 | ₹450 |

| LT Foods Share Price Target 2028 | ₹520 |

| LT Foods Share Price Target 2029 | ₹565 |

| LT Foods Share Price Target 2030 | ₹760 |

| LT Foods Share Price Target 2035 | ₹1280 |

| LT Foods Share Price Target 2040 | ₹1530 |

LT Foods Share Price Target 2025

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹425 | ₹319 | 2025 |

LT Foods Stock Price Target 2026

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹375 | ₹290 | 2026 |

LT Foods Share Price Target 2027

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹450 | ₹365 | 2027 |

LT Foods Ltd Share Price Target 2028

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹520 | ₹395 | 2028 |

LT Foods Ltd Share Price Target 2029

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹595 | ₹430 | 2029 |

LT Foods Share Price Target 2030

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹760 | ₹580 | 2030 |

LT Foods Share Price Target 2035

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹1280 | ₹1090 | 2035 |

LT Foods Share Price Target 2040

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹1530 | ₹1340 | 2040 |

Competitors / Peer Companies

- Varun Beverages

- Hatsun Agro

- Bikaji Foods

- Godrej Agrovet

- Avanti Feeds

Conclusion:

LT Foods has evolved from just a rice company to a global food brand. Strong financials, consistent growth, and future-ready strategies in packaged and organic foods make it a solid long-term player.

Read Also: IRB Infra Share Price Target

FAQs

Disclaimer: The stocks mentioned above are shared purely for informational and research purposes. We are not authorized by SEBI (Securities and Exchange Board of India).These are not investment recommendations. Please make sure to do your own research or consult a financial advisor before making any investment decisions.