Anupam Rasayan Share Price Target 2025–2030: Is ANURAS a Strong Buy?

Anupam Rasayan Share Price Target, India’s chemical industry is booming and Anupam Rasayan India is one of the names quietly making big moves. Listed on the NSE as ANURAS, this Surat-based specialty chemicals company is turning heads with its aggressive expansion, global contracts, and entry into high-growth sectors like EV battery materials.

But is the stock still worth buying in 2025?

Anupam Rasayan India Company Overview

Founded back in 1984, this company is all about custom synthesis — think of it as making complex specialty chemicals tailored to what big pharma, agrochemical giants, or industrial firms need.

- Established: 1984

- Headquarters: Surat, Gujarat, India

- Market Capitalization: Approximately ₹ crore

- Key Segments: Chemicals

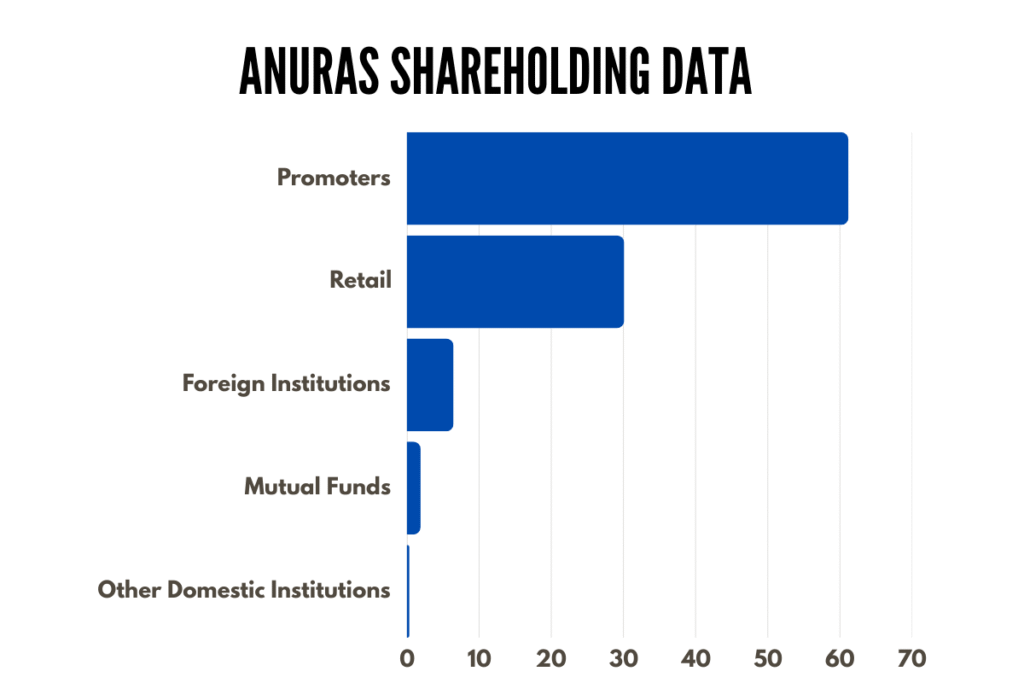

- Promoter Holding: 61.18%

- Retail Holding: 30.11%

- Dividend Yield: 0.14%

- 52-Week Range: ₹601.00 – ₹928.00

ANURAS Fundamentals Overview

ANURAS Overall Market Cap Rs.9950 Cr. and as per the analyst stock is currently trading 3.50 times from its book value, so the Anupam Rasayan share price target should be?

| Market Cap | Rs.9,950 Cr. | ROE | 2.51 |

| P/E Ratio | 124.85 | EPS(TTM | 7.25 |

| P/B Ratio | 3.58 | Dividend Yield | 0.14% |

| Industry P/E | 45.44 | Book Value | 253.13 |

| Debt to Equity | 0.48 | Face Value | 10 |

Anuras share price history of last 10 Years

Here is the last 10 Years of previous data of Anupam Rasayan India stocks

ANURAS Share Financial Overview 2025

Anupam Rasayan share analysis

Pros

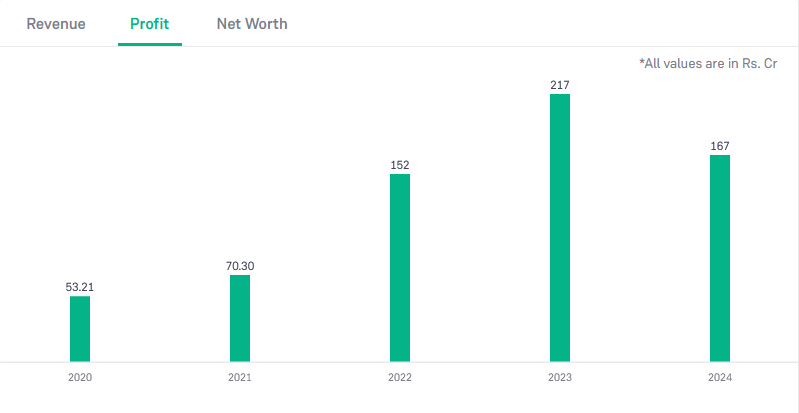

- Company has delivered good profit growth of 20.6% CAGR over last 5 years

Cons

- 3.5x book value: Stock is priced higher than its fundamentals.

- Low ROE: Only 7.33% over the last 3 years, indicating inefficiency in generating profits.

- Increased debtor days: Up from 111 to 143, suggesting slower collections.

- Declining promoter holding: Dropped by 4% over the past 3 years.

Read Also: RVNL Share Price Target 2025, 2030, 2035, 2040

ANURAS Share Latest News

[Date: March 2025]: Anupam Rasayan India Ltd. has signed a 10-year Letter of Intent (LOI) with a Korean multinational company (MNC) for a high-performance, niche chemical, valued at $106 million (approximately ₹922 crore).

ANURAS share price forecast & targets

Anupam Rasayan share price target: As of now, ANURAS is trading around ₹885.60 per share. Investors are showing mixed emotions—some see potential, while others are a bit cautious due to high valuations.

Price Targets from Analysts

- Average analyst target: Around ₹715, suggesting there could be a possible dip from current levels.

- Target range: Varies widely—from ₹520 on the lower side to ₹1,075 on the higher side.

- KR Choksey has a ‘Hold’ rating with a target of ₹694.

- Jefferies recently revised their target down to ₹565, calling the stock ‘Underperform’.

Technical Predictions

- Platforms like TradingView estimate a target around ₹649, with some predicting it might go up to ₹800.

- WalletInvestor gives a 14-day short-term target of ₹1,026, though they also warn it could fall back to around ₹898.

- According to MunafaSutra, support is seen near ₹843, and resistance around ₹892.

Anupam Rasayan share price target 2025

According to recent overview Anupam Rasayan share price target

| Month | Price Target |

|---|---|

| January 2025 | ₹700.50 |

| February 2025 | ₹645.15 |

| March 2025 | ₹710.80 |

| April 2025 | ₹765.40 |

| May 2025 | ₹805.01 |

| June 2025 | ₹780.93 |

| July 2025 | ₹815.87 |

| August 2025 | ₹840.80 |

| September 2025 | ₹790.27 |

| October 2025 | ₹830.73 |

| November 2025 | ₹875.88 |

| December 2025 | ₹890.80 |

Anupam Rasayan share price target 2026

| Month | Price Target |

|---|---|

| January 2026 | ₹770.95 |

| February 2026 | ₹755.63 |

| March 2026 | ₹740.95 |

| April 2026 | ₹760.39 |

| May 2026 | ₹780.19 |

| June 2026 | ₹775.91 |

| July 2026 | ₹790.08 |

| August 2026 | ₹825.32 |

| September 2026 | ₹785.06 |

| October 2026 | ₹744.35 |

| November 2026 | ₹756.89 |

| December 2026 | ₹790.12 |

Anupam Rasayan share price target 2027

| Month | Price Target |

|---|---|

| January 2027 | ₹770.12 |

| February 2027 | ₹798.71 |

| March 2027 | ₹825.91 |

| April 2027 | ₹845.23 |

| May 2027 | ₹822.17 |

| June 2027 | ₹790.11 |

| July 2027 | ₹797.08 |

| August 2027 | ₹822.54 |

| September 2027 | ₹840.24 |

| October 2027 | ₹875.87 |

| November 2027 | ₹890.26 |

| December 2027 | ₹905.42 |

Anupam Rasayan Share Price Target 2028

| Month | Price Target |

|---|---|

| January 2028 | ₹910.20 |

| February 2028 | ₹937.73 |

| March 2028 | ₹959.98 |

| April 2028 | ₹983.06 |

| May 2028 | ₹1,022.43 |

| June 2028 | ₹1,002.48 |

| July 2028 | ₹1,012.60 |

| August 2028 | ₹994.63 |

| September 2028 | ₹980.74 |

| October 2028 | ₹965.28 |

| November 2028 | ₹995.78 |

| December 2028 | ₹1,013.40 |

ANURAS Share Price Target 2029

| Month | Price Target |

|---|---|

| January 2029 | ₹1,001.60 |

| February 2029 | ₹1,030.39 |

| March 2029 | ₹1,055.98 |

| April 2029 | ₹1,030.35 |

| May 2029 | ₹1,005.81 |

| June 2029 | ₹1,042.45 |

| July 2029 | ₹1,065.17 |

| August 2029 | ₹1,095.85 |

| September 2029 | ₹1,116.70 |

| October 2029 | ₹1,132.10 |

| November 2029 | ₹1,150.10 |

| December 2029 | ₹1,165.97 |

ANURAS Share Price Target 2030

| Month | Price Target |

|---|---|

| January 2030 | ₹1,180.90 |

| February 2030 | ₹1,150.24 |

| March 2030 | ₹1,130.27 |

| April 2030 | ₹1,160.51 |

| May 2030 | ₹1,175.11 |

| June 2030 | ₹1,180.56 |

| July 2030 | ₹1,215.40 |

| August 2030 | ₹1,250.88 |

| September 2030 | ₹1,280.78 |

| October 2030 | ₹1,245.40 |

| November 2030 | ₹1,355.48 |

| December 2030 | ₹1,400.60 |

What Investors Should Know

- High Valuation: With a P/E of 124.85 and P/B of 3.58, the stock is definitely not cheap.

- Earnings Quality: A large part of recent earnings includes non-core “other income,” which some may view as a one-off.

- Promoter Holding: Has declined by about 4.21% over the last three years—something worth noting.

- Recent Performance: Despite the concerns, the stock has performed well lately—up over 23% in the last month and 10% in the last year.

Anupam Rasayan Shareholding Pattern

Conclusion

Anupam Rasayan seems to be in a tug-of-war between its solid business prospects and high valuations. If you’re a long-term investor with patience and risk tolerance, it might be worth keeping an eye on. But if you’re looking for short-term gains, the current price might feel a bit stretched.

FAQs

Who are the clients of Anupam Rasayan?

The company caters to over 70 domestic and international customers, including more than 25 multinational corporations. Notable clients include: Syngenta (Switzerland),Sumitomo Chemical (Japan), UPL Ltd (India), Adama Ltd (Israel)

What is the RVNL share price target 2025?

RVNL share price target for 2025 is between ₹700.50 and ₹890.80

What is the target price for Anupam Rasayan in 2030?

Anupam Rasayan share price target for 2030 is between ₹1,180.90 and ₹1,400.60

Does Anupam Rasayan make EV battery chemicals?

Yes, Anupam Rasayan is now in the EV game — and it could be a game-changer for both the company and its investors.

Is Anupam Rasayan a good stock to buy in 2025?

Investor Recommendation: Consider a “Hold” position. Monitor the company’s quarterly performance and market developments closely before making additional investments.

Why anupam rasayan share falling?

Most of the hit came from slower demand in their agrochemical segment. On top of that, the stock was trading at a pretty high valuation, which made investors nervous when earnings didn’t keep up. Some big investors also started pulling out, adding to the sell-off.

In short, weak earnings + high valuation = falling share price.

Disclaimer: The stocks mentioned above are shared purely for informational and research purposes. These are not investment recommendations. Please make sure to do your own research or consult a financial advisor before making any investment decisions.