Lux Industries Share Price Target 2025-2030: A Glimpse into the Future

Lux Industries Share Price Target, When it comes to India’s innerwear and hosiery market, Lux Industries Limited stands tall as a prominent player. But what does the future hold for its stock? Let’s delve into the company’s journey, financial health, and projections for the coming decades.

Company Overview

Established in 1957 as Biswanath Hosiery Mills by Girdharilal Todi, Lux Industries has evolved into a leading manufacturer of innerwear and hosiery products. With a diverse portfolio of brands like Lux Cozi, ONN, Lyra, and Venus, the company caters to men, women, and children across India. The NSE symbol is LUXIND.

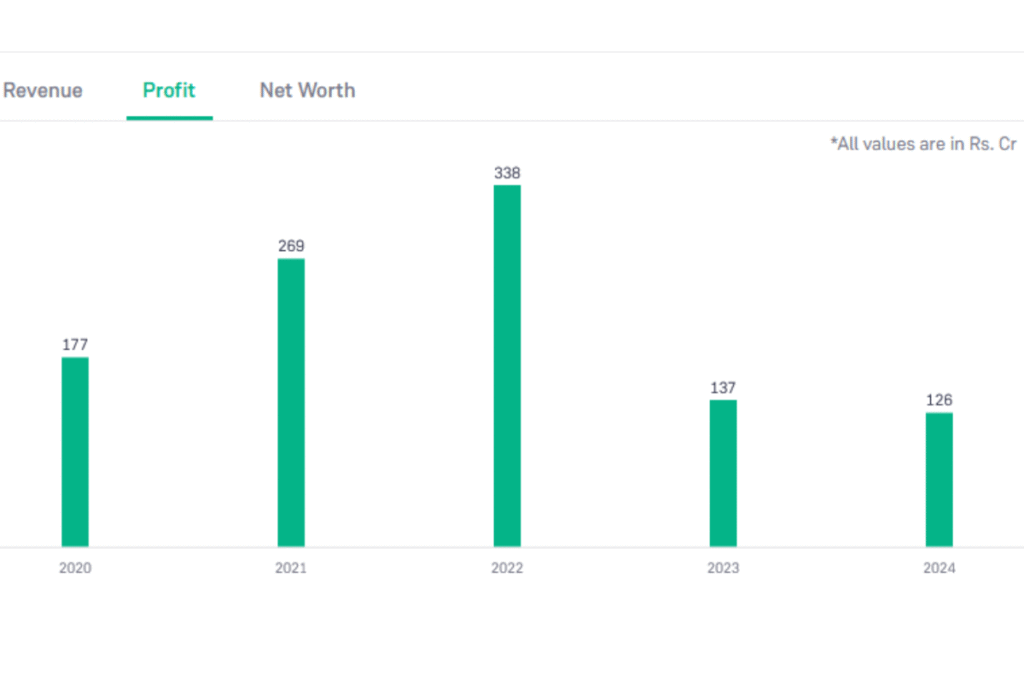

Financial Overview

Lux Industries has demonstrated consistent growth over the years so the Lux Industries Share Price Target:

These figures highlight the company’s robust financial health and efficient capital management.

Current Share Price

Lux Industries Share Price Target, As of May 09, 2025, Lux Industries’ stock is trading at ₹1347.20 on the NSE . This is a significant drop from its all-time high of ₹2493.50 in Aug 2024, reflecting broader market trends and sector-specific challenges.

History of last 10 Years Lux Industries Stocks

Fundamental Metrics

Key metrics as of March 2025 of Lux Industries Share Price Target:

| Market Cap | ₹4057 Cr. | ROE | 9.75 |

| P/E Ratio | 23.48 | EPS(TTM) | 57.45 |

| P/B Ratio | 2.46 | Dividend Yield | 0.15% |

| Industry P/E | 31.42 | Book Value | 548.70 |

| Debt to Equity | 0.15 | Face Value | 2 |

| 52-Week High | ₹1,169.05 | 52-Week Low | ₹2,493 |

Read Also: Anupam Rasayan Share Price Target 2025–2030:Is ANURAS a Strong Buy?

Pros

- Strong Brand Portfolio: Established brands with widespread recognition.

- Low Debt Levels: Ensures financial flexibility.

- Consistent Profitability: Demonstrated ability to generate steady profits.

Cons

- High Valuation: Elevated P/E and P/B ratios may deter value investors.

- Market Volatility: Stock price fluctuations influenced by broader market conditions.

Lux Industries Latest News

[Date: 5 April 2025]: Lux Industries Ltd. has informed the BSE that its Board of Directors will meet on May 23, 2025, to discuss and approve various matters, including the official notice of the meeting.

Lux Industries Share Price Target – Long-Term Forecast

While stock price predictions are never an exact science, let’s take an educated guess based on current growth trends, market demand, and fundamentals.

Lux Industries Stock Price Target 2025

| Maximum Target | Minimum Target | Year |

| 1190 | 2100 | 2025 |

Lux Industries Share Price Target 2026

| Maximum Target | Minimum Target | Year |

| 1700 | 2500 | 2026 |

Lux Industries Stock Price Target 2027

| Maximum Target | Minimum Target | Year |

| 1900 | 2700 | 2027 |

Lux Industries Stock Price Target 2028

| Maximum Target | Minimum Target | Year |

| 2050 | 2850 | 2028 |

Lux Industries Stock Price Target 2029

| Maximum Target | Minimum Target | Year |

| 2100 | 3150 | 2029 |

Lux Industries Share Price Target 2030

| Maximum Target | Minimum Target | Year |

| 2400 | 3300 | 2030 |

Shareholding Pattern

As of Mar 2025 the shareholding data of LUX Industries are as following:

| Month | Promoters | Retail & Others | Foreign Institutions | Other Domestic Institutions | Mutual Fund |

|---|---|---|---|---|---|

| Mar 2025 | 74.19% | 19.75% | 1.21% | 4.77% | 0.07% |

| Dec 2024 | 74.19% | 19.74% | 1.24% | 4.75% | 0.08% |

| Sep 2024 | 74.19% | 19.82% | 1.14% | 4.77% | 0.08% |

| Jun 2024 | 74.19% | 20.14% | 0.84% | 4.78% | 0.05% |

This promoter-heavy structure shows that the founding family still firmly believes in their brand.

Conclusion:

Is Lux a Good Fit for Your Portfolio?

Lux Industries Share Price Target, Lux Industries is like a well-made cotton vest — not flashy, but reliable and comfortable over time. For investors looking at long-term growth rather than short-term gains, Lux might just be a good fit.

But as always, keep an eye on raw material prices, competition, and earnings consistency. In a sector where loyalty and margins matter, Lux has a definite edge — but it still needs to innovate to stay ahead.

Disclaimer: The stocks mentioned above are shared purely for informational and research purposes. We are not authorized by SEBI (Securities and Exchange Board of India).These are not investment recommendations. Please make sure to do your own research or consult a financial advisor before making any investment decisions.

FAQs

Is Lux Industries a good stock for long-term investors?

Yes, especially if you believe in India’s consumer growth story and prefer financially sound companies.

Does Lux Industries pay dividends?

Yes, it regularly distributes dividends to shareholders.

Why did Lux Industries’ stock price fall from its all-time high?

Partly due to post-COVID normalization, input cost pressures, and overall market volatility so depends open various thing.

What is the future outlook for Lux Industries?

With strategic initiatives focusing on brand expansion and market penetration, Lux Industries is poised for continued growth.