Urja Global Share Price Target 2025 to 2040 Analysis & Forecast

Urja Global Ltd. is one of India’s leading renewable energy companies engaged in the design, consultancy, integration, supply, and maintenance of off-grid and grid-connected solar power plants. It also operates in e-vehicles, batteries, and solar panels, aiming to become a key player in India’s green energy mission. So here we will review the company’s fundamental, growth and predict the Urja Global Future Growth.

Company Overview

- Established: 1992

- Managing Director: Mr. Mohan Agarwal

- Stock Symbol: URJA (NSE)

- Date of Listing: 28-Mar-2017

- Sector: Automobile

- Website: urjaglobal.in

- Subsidiaries: Urja Batteries Limited, Sahu Minerals & Properties Ltd., Bharat Accumulators Ltd.

Fundamental Metrics

Urja Global has gained attention due to its involvement in green energy and electric mobility. This stocks have high P/E ratio, and Promoter holding is low but the investors still consider it a speculative growth stock. Here are some fundamentals as of March 2025 :

| Market Cap | ₹808 Cr | ROE | 1.16% |

| P/E Ratio | 505 | EPS (TTM) | 0.03 |

| P/B Ratio | 4.65 | Dividend Yield | 0.00% |

| Industry P/E | 24.66 | Book Value | 3.32 |

| Debt to Equity | 0.04 | Face Value | 1 |

| 52-Week High | ₹25.4 | 52-Week Low | ₹10.7 |

Read Also: Tilak Ventures Share Price Target

Pros

- Low Debt: The company is virtually debt-free, reducing financial risk.

- Positive Outlook: It’s expected to post a strong quarter ahead.

- Improved Collections: Debtor days dropped from 171 to 124 – a sign of better cash flow management.

Cons

- Overvalued? Stock is trading at 4.63x its book value.

- No Dividends despite consistent profits.

- Poor Sales Growth: -20.1% over the last 5 years.

- Low Promoter Holding: Just 19.4%.

- Falling Promoter Stake: Down by 12.5% in 3 years.

- Low ROE: Only 0.85% in the past 3 years.

- Other Income Boost: Earnings include ₹1.33 Cr from non-core sources.

Urja Global Financial Overview 2025

Current Share Price

As of the latest data, Urja Global stocks price is around ₹15.38

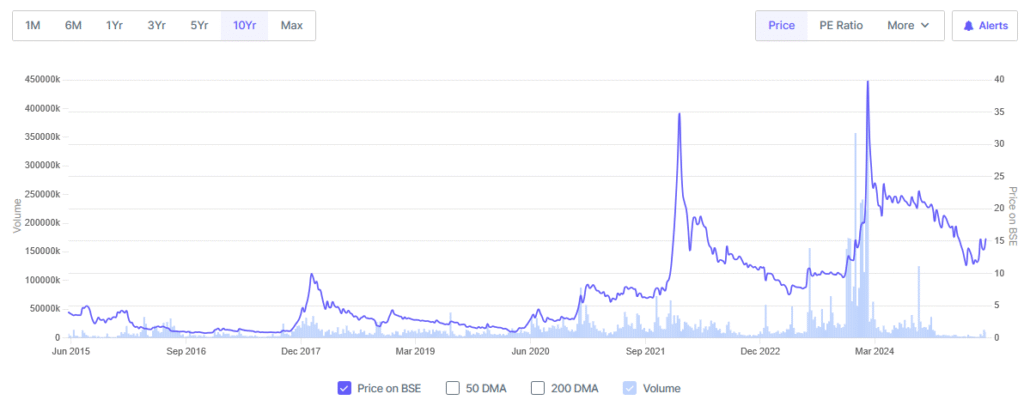

Urja Global Share Price History of last 10 Years

Over the past decade, Urja Global’s stock has been highly volatile. It has witnessed sharp speculative rallies due to announcements in the renewable space.

Read Also: Infibeam Share Price Target

Shareholding Pattern

As of Mar 2025 the shareholding data are as following:

| Month | Promoters | FIIs | DIIs | Public |

|---|---|---|---|---|

| Mar 2025 | 19.43% | 0.12% | 0.00% | 80.43% |

| Mar 2024 | 19.43% | 0.06% | 0.00% | 80.49% |

| Mar 2023 | 28.65% | 0.00% | 0.00% | 71.35% |

| Mar 2022 | 31.97% | 0.02% | 0.00% | 68.00% |

| Mar 2021 | 31.97% | 0.43% | 0.01% | 67.58% |

Urja Global Share Price Forecast 2025 to 2040

| Year | Target Price |

|---|---|

| Urja Global Share Price Target 2025 | ₹17 |

| Urja Global Share Price Target 2026 | ₹20 |

| Urja Global Share Price Target 2027 | ₹16 |

| Urja Global Share Price Target 2028 | ₹18 |

| Urja Global Share Price Target 2029 | ₹22 |

| Urja Global Share Price Target 2030 | ₹29 |

| Urja Global Share Price Target 2035 | ₹39 |

| Urja Global Share Price Target 2040 | ₹60 |

Urja Global Target Price 2025

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹17 | ₹11 | 2025 |

Urja Global Ltd Share Price Target 2026

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹20 | ₹13 | 2026 |

Urja Global Ltd Share Price Target 2027

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹16 | ₹9 | 2027 |

Urja Global Ltd Share Price Target 2028

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹18 | ₹11 | 2028 |

Urja Global Ltd Share Price Target 2029

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹22 | ₹13 | 2029 |

Urja Global Share Price Target 2030

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹29 | ₹17 | 2030 |

Urja Global Target Price 2035

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹39 | ₹22 | 2035 |

Urja Global Share Price Target 2040

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹60 | ₹25 | 2040 |

Competitors / Peer Companies

- Eicher Motors

- TVS Motor Co.

- Hero Motocorp

- Ola Electric

- Wardwizard Inno.

- Tunwal E-Motors

Urja Global is still a smaller player compared to these giants but is attracting attention for its aggressive future roadmap.

Conclusion:

Urja Global holds promise in the clean energy revolution, but it remains a high-risk, high-reward stock. Investors should closely monitor its fundamentals, management execution, and sectoral growth before making long-term commitments.

Read Also: LT Foods Share Price Target 2025 to 2040

FAQs

Disclaimer: The stocks mentioned above are shared purely for informational and research purposes. We are not authorized by SEBI (Securities and Exchange Board of India).These are not investment recommendations. Please make sure to do your own research or consult a financial advisor before making any investment decisions.