Sharanam Infraproject Share Price Target: 2025 to 2030 Forecast & Stock Analysis

In this article, we’ll take a close look at the Sharanam Infraproject share price target for the next few decades, along with its financial performance, stock history, growth drivers, and long-term projections. If you’re considering adding infrastructure stocks to your portfolio, this is a must-read!

Company Overview

Sharanam Infraproject and Trading Limited began its journey on February 5, 1992, originally incorporated as Skyhigh Projects Limited. The company adopted its current name on July 29, 2015, reflecting a broader vision and new direction.

Sharanam Infraproject is an infrastructure development company that specializes in construction, civil engineering, and real estate development. With a focus on large-scale projects, including highways, residential complexes, commercial spaces, and government contracts, Sharanam Infraproject has positioned itself as a key player in India’s rapidly expanding infrastructure sector.

- Established: 1992

- Managing Director: Pratikkumar Shamjibhai Bhalodiya

- Stock Symbol: 539584 (BSE)

- Sector: Trading

- Website: sharanaminfra.co.in

Fundamental Metrics

Key metrics as of March 2025:

| Market Cap | ₹27.9 Cr. | ROE | 0.43 % |

| P/E Ratio | 18.9 | EPS(TTM) | 0.03 |

| P/B Ratio | 0.48 | Dividend Yield | 0.00 % |

| Industry P/E | 96.80 | Book Value | 0.18 |

| Debt to Equity | 0.00 | Face Value | 1 |

| 52-Week High | ₹1.12 | 52-Week Low | ₹0.43 |

Read Also: Tilak Ventures Share Price Target

Cons

- Stock is trading at 2.56 times its book value, indicating a premium valuation.

- Return on equity is low at -0.84% over the last 3 years, showing weak profitability.

- Debtor days are high at 560, raising concerns about cash flow and collections.

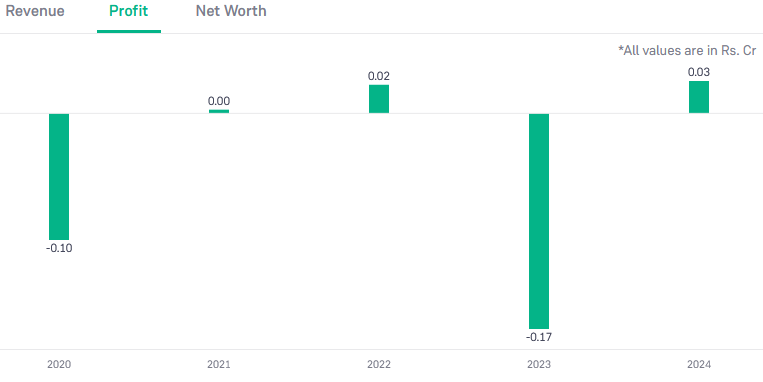

Sharanam Infraproject Financial Overview 2025

Current Share Price

As of the latest data, sharanam infraproject share price around ₹0.47

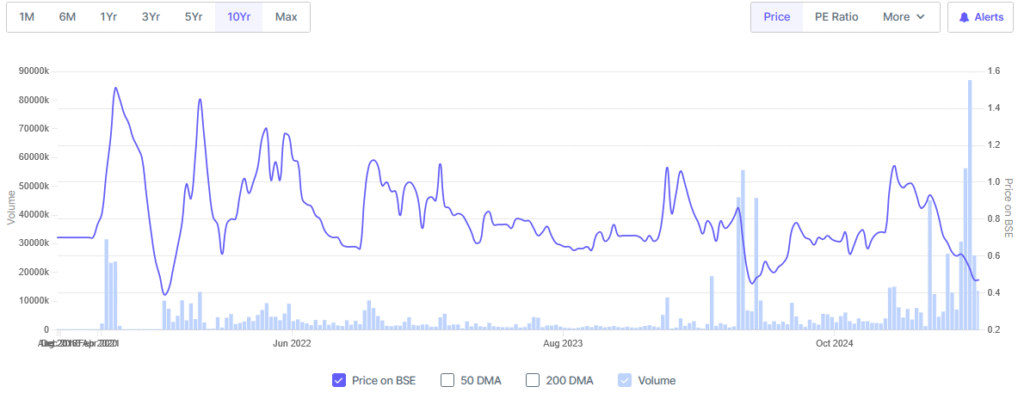

History of last 10 Years Tilak Ventures Ltd stocks

Read Also: Infibeam Share Price Target

Shareholding Pattern

As of Mar 2025 the shareholding data are as following:

| Month | FIIS | Public |

|---|---|---|

| Mar 2025 | 1.52% | 98.48%% |

| Dec 2024 | 0.00% | 100.00% |

| Sep 2024 | 0.00% | 100.00% |

| Jun 2024 | 0.00% | 100.00% |

| Mar 2024 | 0.00% | 99.99% |

Sharanam Infraproject Stock Price Forecast 2025 to 2030

| Year | Target Price |

|---|---|

| Sharanam Infraproject Share Price Target 2025 | ₹0.70 |

| Sharanam Infraproject and Trading ltd Share Price Target 2026 | ₹0.90 |

| Sharnam Infrastructure Share Price Target 2027 | ₹1.15 |

| Sharanam Infraproject Share Price Target 2028 | ₹1.70 |

| Sharanam Infraproject Share Price Target 2029 | ₹1.50 |

| Sharanam Infraproject Share Price Target 2030 | ₹2.05 |

Sharanam Infraproject Share Price Target 2025

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹0.70 | ₹0.40 | 2025 |

Sharanam Infraproject and Trading ltd Share Price Target 2026

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹0.90 | ₹0.45 | 2026 |

Sharanam Infraproject Share Price Target 2027

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹1.15 | ₹0.65 | 2027 |

Sharanam Infra Project Share Price Target 2028

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹1.70 | ₹0.32 | 2028 |

Sharnam Infrastructure Share Price Target 2029

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹1.50 | ₹0.70 | 2029 |

Sharanam Infraproject Share Price Target 2030

| Maximum Target | Minimum Target | Year |

|---|---|---|

| ₹2.05 | ₹0.65 | 2030 |

Peer Company

- Avenue Super.

- Trent

- Vishal Mega Mart

- Brainbees Solut.

- Medplus Health

- Redtape

- V-Mart Retail

Conclusion:

Sharanam Infraproject is a small cap or it’s penny stocks poised for significant growth in India’s infrastructure sector. With its strong project pipeline, disciplined financial management, and focus on sustainability, Sharanam Infraproject’s share price target indicates promising long-term potential.

Read Also: IRB Infra Share Price Target

Disclaimer: The stocks mentioned above are shared purely for informational and research purposes. We are not authorized by SEBI (Securities and Exchange Board of India).These are not investment recommendations. Please make sure to do your own research or consult a financial advisor before making any investment decisions.